crypto tax calculator nz

If you are an accountant you can also work with the Crypto Tax Calculator for 499year. Import Your Crypto Trades.

Crypto Tax Calculator Cryptocurrency And Nft Tax Software Review

Start by importing your crypto trading history from all years and from all exchanges into the app.

. Trading and exchanging crypto Trading one cryptocurrency for another is a taxable event. B If you are new or returning tax resident after 10 years Eligible for a 4-year temporary tax exemption on most types of foreign income. They use software to keep a record of all your trades so that you can easily convert them into AUD equivalents.

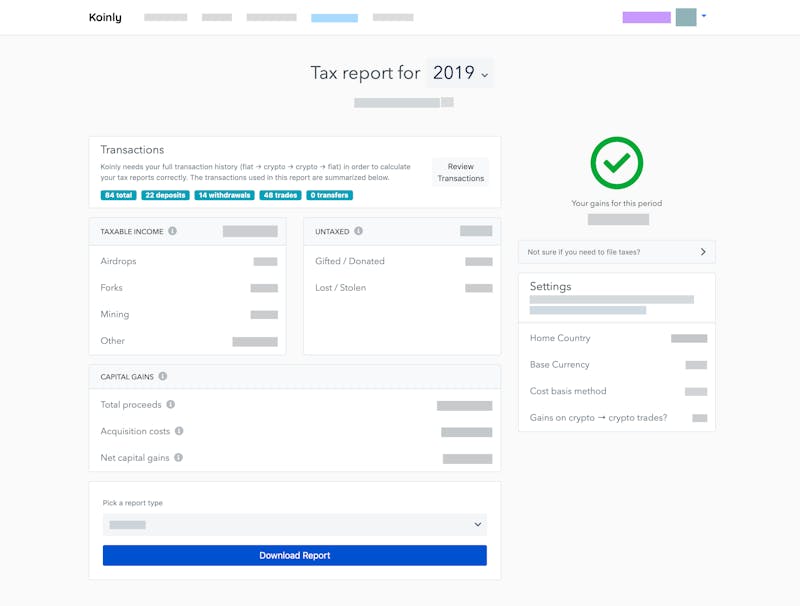

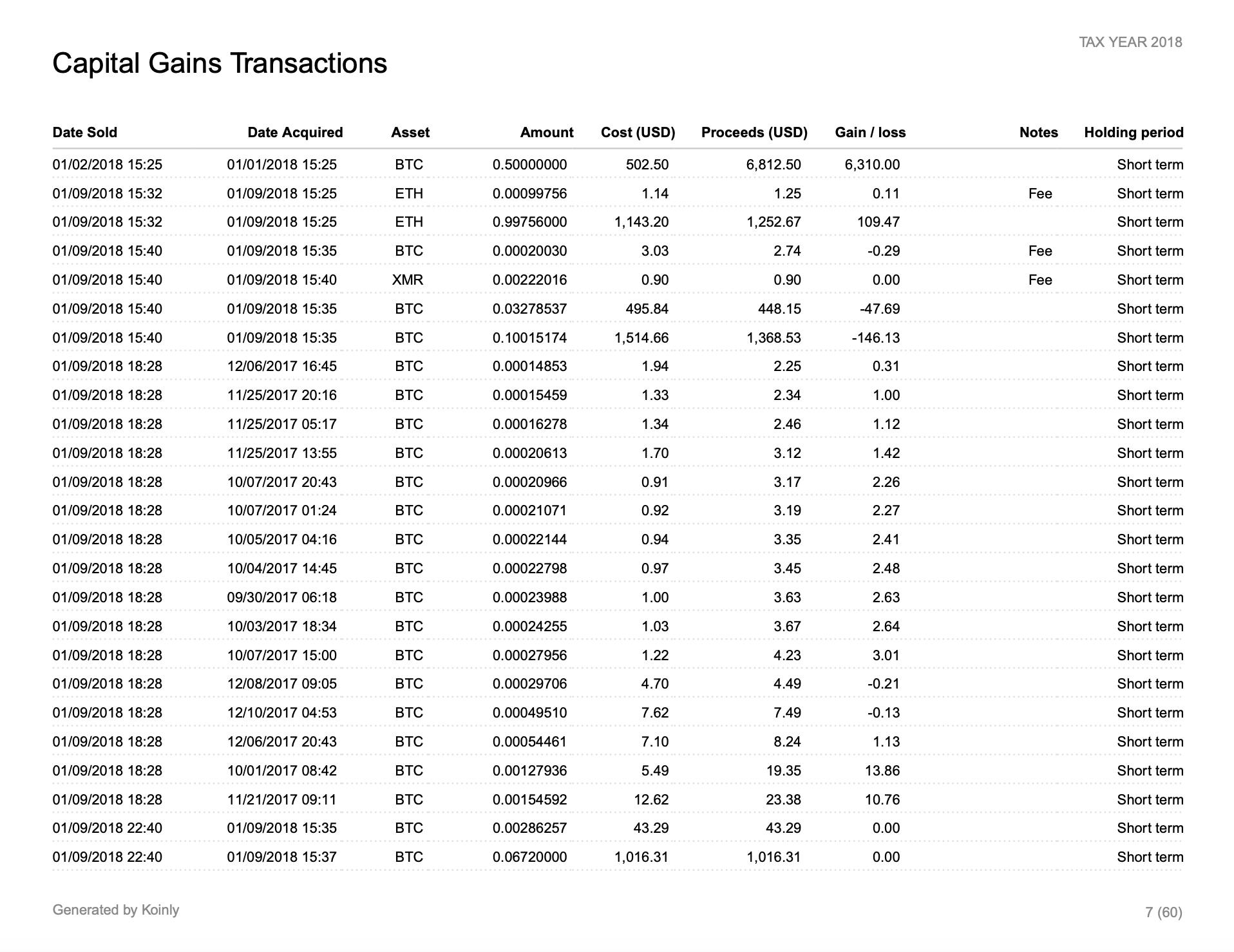

You need to file a tax return when you have taxable income from your cryptoasset activity. Capital gains report Download your capital gains report which shows your short and long term gains separately. Cryptocurrency Tax Calculator.

Making a stablecoin trade Trading a cryptocurrency for a stablecoin is a taxable event. File your crypto taxes in New Zealand Learn how to calculate and file your taxes if you live in New Zealand. Selling crypto for fiat eg NZD is a taxable event examples below Trading one coin for another is a taxable event.

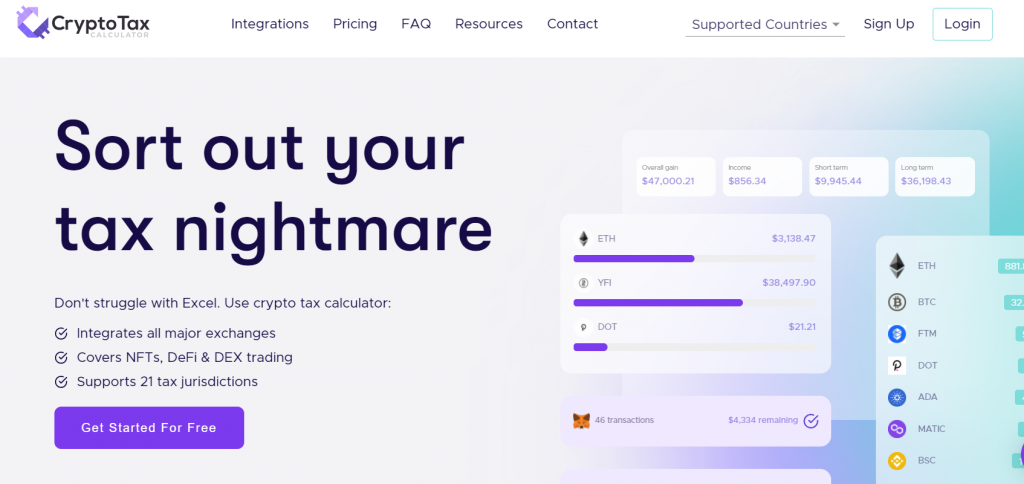

Using crypto to purchase goods or services is a taxable event. Over 500 integrations with support for complex scenarios such as DeFi NFTs. An unrealised profit is when the market value of a token is higher than the original purchase price.

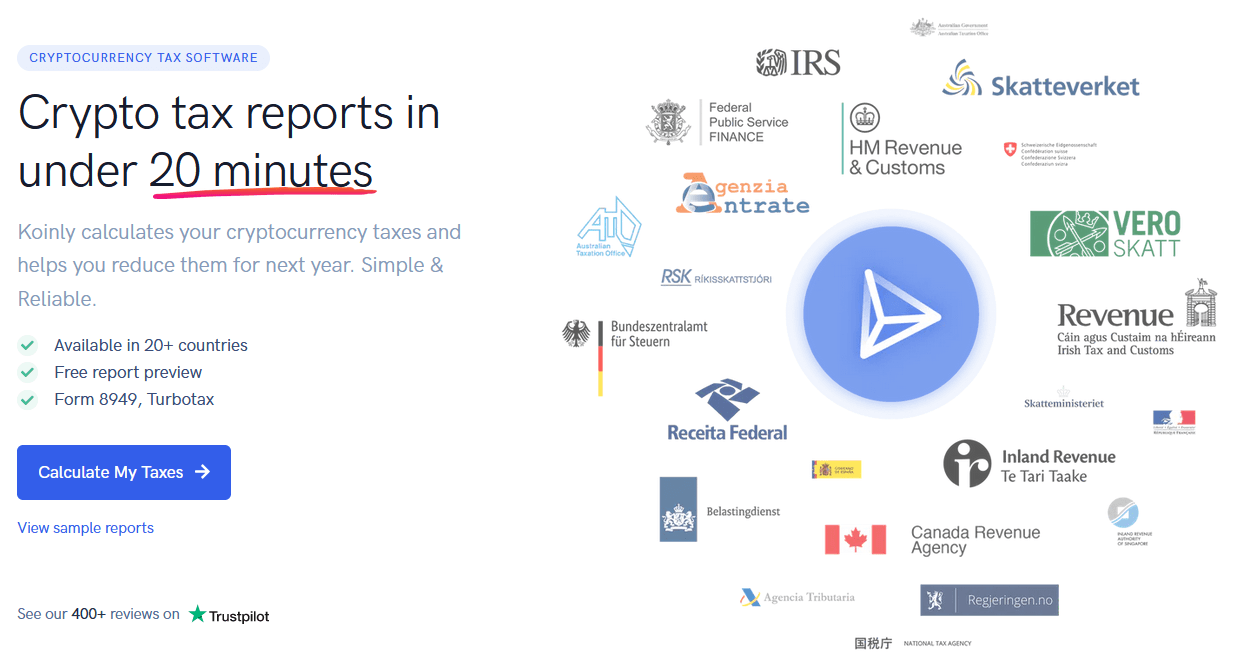

Koinly can generate the right crypto tax reports for you. Receiving mining or staking rewards. How Does The CryptoTraderTax Calculator Work.

If youre converting between crypto and non NZD currencies you cannot use the apps NZD converter as it probably wont be the same as conversion rates released by the IRD for the tax conversion purposes. Log in with Google. Taxoshi is a cryptocurrency tax calculator focused on helping kiwis understand their tax position.

Crypto tax calculators are used by crypto enthusiasts all over the world to help automate their crypto and bitcoin tax reporting. Mining staking income. Calculating the New Zealand dollar value of cryptoassets.

Capital gains tax report. This unfortunately means that theres a tax risk for those who hold or have made money in crypto. You may be eligible for a tax refund if your tax rate is lower or may owe tax if.

Calculate the New Zealand dollar value of your cryptoasset transactions. 07 823 4980 or email us. Work out your cryptoasset income and expenses.

You need to use amounts in New Zealand dollars NZD when filing your income tax return. We have a list of certified tax accountants in New Zealand that specialize in cryptocurrencies. Making a purchase with cryptocurrency.

All New Zealand residents are taxed in their income but non-residents can also be taxed if their crypto-asset income has a source in NZ. Exchanging your cryptoassets for different cryptoassets. Taxable crypto events.

Tax-Loss Harvesting With A Crypto Tax Calculator In general terms losses resulting from cryptocurrency trades are tallied against any gains made in the current year. All plans have a 30-day money-back guarantee. Some cryptoasset transactions may not have an NZD value such as.

Alternatively Swyftx partners with both Koinly and Crypto Tax Calculator who offer crypto tax reporting services to taxpayers in Australia. Sort out your crypto tax nightmare Crypto taxes can be painful but with our easy-to-use tool you can prepare your taxes in a matter of minutes. Crypto CPAs in New Zealand.

Log in to your account. Before you can put your cryptoasset net income or loss in your tax return you need to. Selling crypto Tax is applied when you sell crypto for a profit and will either be a short- or long-term tax rate.

Contact us today to discuss your situation and how we can help. CryptoTaxCalculator 1354 followers on LinkedIn. Koinly helps New Zealanders calculate their income from crypto trading Mining Staking Airdrops Forks etc.

Morris says releasing an updated guide is a good opportunity for people to review the tax positions they have taken previously and make voluntary disclosures if their income from crypto-assets hasnt. For New Zealand customers we recommend reading our 2022 NZ crypto tax guide. The tax residency status of an individual affects how tax is paid in New Zealand on the cryptoasset income.

We are Chartered Accountants who specialise in cryptocurrency taxation. It is worth noting that The Crypto Tax Calculator offers a free-trial period 30 days as well. Income report - Mining staking etc.

A If you are a tax resident Taxed on worldwide income including cryptoasset income from overseas. The profits being made in crypto investing are still dwarfed by the profits of NZ business NZ property speculation or NZ investment so its not unreasonable that IRD havent turned their eye towards making their position clear. Reflects dividend being taxed at a rate of 33.

49 for all financial years. Simply copy the numbers into your annual tax return. Whether you are filing yourself using a tax software like TurboTax or working with an accountant.

Online Crypto Tax Calculator with support for over 400 integrations. Note however that first short-term losses are applied against short-term gains and long-term losses are applied against long-term gains. The tax treatment of crypto assets first became a hot issue in 2016 when the price of bitcoin rose from US500 to US1200 and continued to climb strongly to almost US20000 by the end of 2017.

Download your tax documents. Buying crypto is not a taxable event see example 2 below. Our step by step wizard and cryptocurrency tax calculator is fine-tuned for New Zealand and will help you figure out your crypto tax position to declare.

Check out our free guide on crypto taxes in New Zealand. The platform offers you ten clients and up to 100000 transactions per client. We have a range of services available for investors traders miners and businesses involved with cryptocurrency.

Calculate the net dividend youll receive for a given NZX listed company based on the number of shares you own. Generate complete tax reports for mining staking airdrops forks and other forms of income.

Cryptocurrency Taxes What To Know For 2021 Money

Koinly Vs Cryptotrader Tax Which Tax Calculator Is Better Captainaltcoin

Koinly Crypto Tax Calculator For Australia Nz

Tax Time Blue Tinted Image Of Calculator And Figures On Paper Selective Focus Ad Tinted Image Calculator Tax Time Ad Tax Time Tax Calculator

Koinly Review And Alternatives Is It The Best Crypto Listy

Cryptocurrency Tax Reports In Minutes Koinly

3 Steps To Calculate Coinbase Taxes 2022 Updated

How To Buy Cryptocurrency In Australia Buy Cryptocurrency Bitcoin Cryptocurrency

Crypto Tax Calculator Review April 2022 Finder Com

Capital Gains Tax Calculator Ey Us

How To Calculate Crypto Taxes Koinly

New Zealand Calculate And File Bitcoin Crypto Taxes Coinpanda

Calculator And Euro Banknotes On A Table Free Image By Rawpixel Com Karolina Kaboompics Time Value Of Money Earn More Money Free Money

Cryptotaxcalculator Io Review 2022 Is Cryptotaxcalculator Legit Safe

Cryptocurrency Tax Reports In Minutes Koinly

Koinly Review And Alternatives Is It The Best Crypto Listy

5 Best Crypto Tax Software Accounting Calculators 2022

5 Best Crypto Tax Software Accounting Calculators 2022

I Built An Income Tax Calculator Using Formidable Forms For The Cook Islands Govcrate Blog